Interest on government borrowing surged to a December record last month due to rocketing inflation, according to official figures.

The Office for National Statistics (ONS) said interest payments on government debt trebled to a higher-than-expected £8.1 billion last month, up from £2.7 billion in December 2020 and the highest for any December on record.

It came as UK inflation has raced to levels not seen for three decades due to soaring energy and fuel prices and as a result of supply chain problems.

The ONS said the jump in UK debt interest payments is down to the recent surge in the Retail Prices Index (RPI) measure of inflation, which determines payouts on index-linked gilts.

RPI rose to its highest level since March 1991, hitting 7.5% last month, up from 7.1% in November.

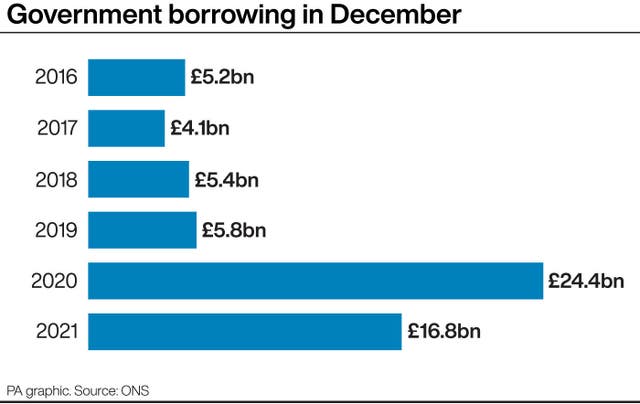

The ONS data showed that the rising interest payments came despite borrowing falling year on year to £16.8 billion in December, down by £7.6 billion from the same month a year earlier.

Public sector borrowing from the end of March to December was £146.8 billion, the second highest since records began in 1993, but down by £129.3 billion in 2020-21 at the height of the pandemic.

The year-to-date figure is also £12.9 billion less than forecast by the Office for Budget Responsibility (OBR).

The data showed that public sector debt, excluding public sector banks, was £2.34 trillion at the end of the month, or around 96% of gross domestic product (GDP).

Chancellor Rishi Sunak said: “Risks to the public finances, including from inflation, make it even more important that we avoid burdening future generations with high debt repayments.

“Our fiscal rules mean we will reduce our debt burden while continuing to invest in the future of the UK.”

Experts have warned that interest payments on public debt will rise further yet as Consumer Prices Index (CPI) inflation is set to increase from 5.4% currently to above 6% in the spring.

Higher interest rates also affect payments on government borrowing, with the OBR previously warning that even a one percentage point rise in rates would cost the UK an extra £23 billion in interest payments on its huge debt mountain.

Rates were hiked to 0.25% last month and are widely expected to increase again as soon as February as the Bank of England moves to cool rampant inflation.

Samuel Tombs at Pantheon Macroeconomics said: “Surging inflation is making the Chancellor’s task of returning the public finances to a sustainable footing much more difficult.

“Despite this, Mr Sunak probably still will intervene in the Spring Statement on March 23, if not sooner, to alleviate the ‘cost of living crisis’ set to engulf households in April.”

He is predicting some action to limit the increase in Ofgem’s energy price cap, but for the Chancellor to resist mounting calls to defer the planned rise in National Insurance contributions this April.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here